Understanding tax credit eligibility can feel overwhelming and confusing. More often than not, day-to-day operations are time-consuming and take precedence over everything else. In addition, industry was hit hard by COVID-19, which is why there has never been a more critical time for business owners to determine which tax credits they are eligible to receive—the potential benefit is too great to pass up.

Specialized Tax Incentives

What is Cost Segregation?

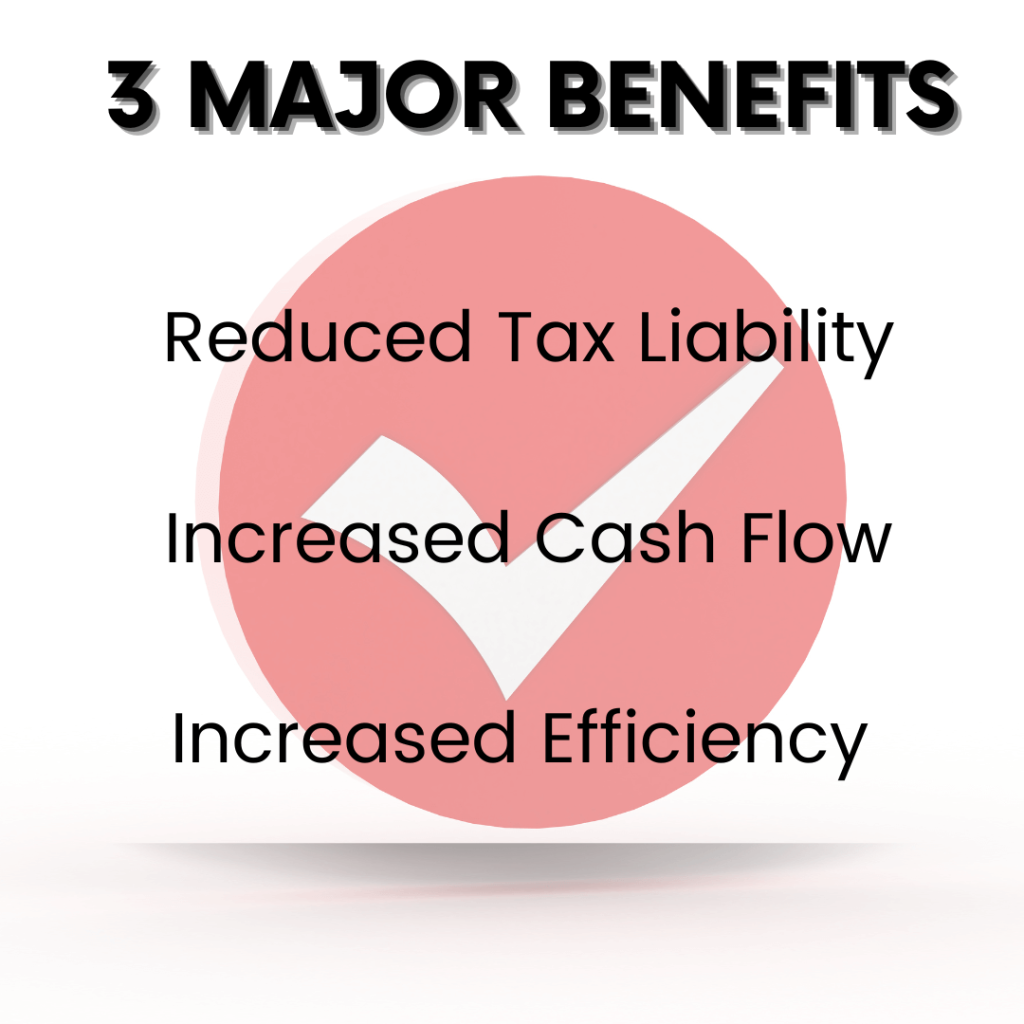

Cost Segregation is a strategic tax savings tool that allows companies and individuals who have constructed, purchased, expanded, or remodeled real estate to increase their cash flow by accelerating depreciation deductions and deferring their federal and state income taxes.

If you own or lease real estate, Cost Segregation could benefit you. A study is typically feasible for buildings purchased, constructed or renovated in the past 10 years. An average Cost Segregation Study offers approximately $150,000 in additional depreciation per $1 million in purchase or construction cost.

How Does Cost Segregation Work?

When you purchase a property, you have purchased the building and all the components that make up that building. Real property is typically depreciated over 39 years (27.5 years for residential), and 20%-40% of the purchase can often be separated into personal property and depreciated quicker. With that accelerated depreciation, you can claim higher deductions and pay less taxes, especially in the early years of your property’s life. The increased cash flow can ease short-term financial burdens. Additionally, By identifying and separating the components of a property, a cost segregation study can help you more efficiently manage and maintain your property, reducing operating costs over time.

Only One Step Away

Step 1: Upload Your Documentation

This is the only step you need to do. We will take care of the rest. Simply answer a few questions and submit your documents and we will provide your preliminary feasibility report.

Step 2: We Calculate, You Claim

Our team will examine your full submission and will use IRS guidelines to create your engineered cost segregation study. We will provide the report to your CPA who will use your findings to file a 3115 with the IRS to complete your claim.

Step 3: Earn Tax Credits Continuously

Cost Segregation is just the beginning. The Tax Management System will continue to search for all available tax credits and incentives for your business on an ongoing basis. Let us find you every penny you’re entitled to!

Misconceptions About Cost Segregation

Should I Do A Cost Segregation Study

Any company that has acquired, renovated or built a property in the past 15 years has a significant opportunity to improve their cash flow and reduce tax liability via a Cost Segregation study. It can be utilized for both residential and nonresidential real estate. The benefits can vary widely, since it’s dependent on identifying components of the real property that are nonstructural and will be eligible for shorter class lives. For example, a manufacturing facility will typically yield more than a warehouse since more specialty work will be needed for the manufacturing process than would otherwise be required for the building.

What Is Bonus Depreciation?

Bonus depreciation permits the additional write-off of an eligible asset’s value in addition to standard depreciation. New assets with class lives of 20-years or less are eligible, which significantly boosts tax savings. The Tax Cuts for Jobs Act (TCJA) allows bonus depreciation to be taken on used assets placed-in-service on or after 9/28/2017. The bonus depreciation rate is 100% for eligible assets placed-in-service between 9/28/2017 and 12/31/2022.? The rate has decreased to 80% for projects placed-in-service in 2023, and will continue to decline by 20% annually through 2026.?

Is Cost Segregation Worth It?

Cost Segregation is undoubtedly “worth it” in terms of ROI. Fees will vary depending on your project’s scope, size, and complexity. Our clients generally find a tax savings of $150,000 for every $1,000,000 in purchase, construction, or renovation costs. We stay current on legislation and monitor your situation; thus, when new savings opportunities become available, we work with you to get every penny you deserve.

Using the online calculator will provide an estimate and a feasibility report that will help you decide if it’s “worth it” to you.

Get started with an established industry leader and claim your funds now.

By leveraging government tax credits, businesses can continue expanding operations and accelerating their industry presence. As an industry leader for over twenty-three years, we have identified over $37B in incentives for our clients. Let our expertise work for you. Our team of professionals will navigate the process for you and get your tax credits immediately.